Starting September 1, every bet at FanDuel in Illinois will include a 50-cent surcharge. With the move, the operator plans to pass Illinois’ new per-bet tax on to the customers, setting an industry precedent.

The big question now: will rival DraftKings follow suit, and could this become an industry standard?

Flutter Responds to Illinois Tax Hike

The FanDuel announcement comes as no surprise to many. On May 31, the Illinois legislature passed a new tax hike on every bet made in the state. Under the new tax, operators will pay 25 cents for every bet placed on their platforms up to the first 20,000 bets. After that threshold, the tax increases to 50 cents per bet.

The 50-cent tax directly applies to FanDuel, the sports betting market leader in the US. While Illinois lawmakers believe that large corporations like FanDuel and DraftKings can afford the increase, the company doesn’t share their view.

In a press release, Peter Jackson, CEO of FanDuel’s parent company, Flutter, said:

“It is important to recognize that there is an optimal level for gaming tax rates that enables operators to provide the best experience for customers, maximize market growth, and maximize revenue for states over time.”

Flutter stressed that this is the second tax hike in a year in Illinois. In 2024, FanDuel’s tax rose from 15% to 40%. The company emphasized that at the time, it made “extensive efforts” to absorb the cost without affecting its customers.

Flutter highlights that if Illinois decides to reverse its decision on the new tax, FanDuel will immediately remove the surcharge.

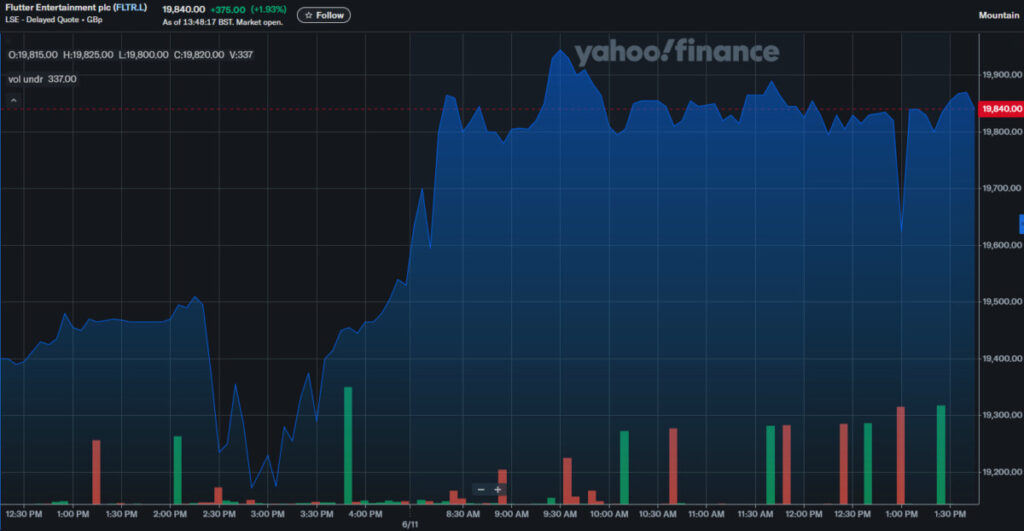

Flutter Investors Shrug Off The Surcharge News

After the Illinois tax news, Flutter’s stock dipped 2%, but investors seem to have welcomed FanDuel’s bold move. After the announcement, the stock closed on Tuesday up 1.5% at $267.52.

The rebound suggests that investors view FanDuel’s decision to pass the tax on to customers as a pragmatic and disciplined move, rather than a sign of financial weakness.

Analysts estimated that the new tax hike in Illinois would reduce Flutter’s US profits by $74 million annually. However, the surcharge announcement appears to have reassured investors that Flutter will protect margins.

In addition, Flutter reiterated that it expects to grow its group-wide profit by 35% to $3.18 billion, maintaining its forecasts. That news likely increased investor confidence as well.

Flutter’s move is also gaining approval from analysts. A consensus of 22 analysts suggests a one-year stock price target of around $300, implying a 12% increase from the current price. Twenty-one brokerage firms maintain an “outperform” rating for the company.

Meanwhile, gambling industry consultant and analyst Steve Ruddock sees the surcharge as a positive move for the company:

“FanDuel is doing the right thing by transparently showing its customers the cost and its source. Like a mom-and-pop store charging a credit card transaction fee, or a restaurant highlighting the meal tax on the receipt rather than raising menu items, transparency is always good.”

DraftKings Weighs Its Options

FanDuel’s main rival, DraftKings, experienced a 2.6% stock rise on Tuesday. That reflects optimism that the operator might avoid adding a surcharge, at least in the short term.

So far, DraftKings has been cautious. In an emailed statement, the company said that it “anticipates taking action and expects to share more information soon.”

But many analysts think a surcharge is inevitable. Jefferies analyst David Katz expects DraftKings to follow FanDuel’s decision:

“Given the structure of the tax, a surcharge is the most direct cost offset, and we view the move as a modest positive for the shares of the operators.”

Katz doesn’t expect either company to lose market share to smaller operators, which could also impose a surcharge. Combined, FanDuel and DraftKings take about 75% of the Illinois sports betting market.

Citizens’ gaming analyst estimates that the new surcharge will result in $79 million in new 2026 revenue for DraftKings (if it implements it), or 5.4% of its projected EBITDA. Meanwhile, FanDuel will generate $86 million, or approximately 2% of its 2026 EBITDA.

Could Per-Bet Surcharges Spread Nationwide?

FanDuel’s surcharge could be a turning point in the US sports betting industry. Once taboo, passing tax costs to consumers could become a standard practice for operators to resist tax hikes.

BMO Capital Markets analyst Brian Pitz said that Flutter’s move illustrates how operators might respond to regulation:

“New fees on every bet could drive users to leverage illegal operators who won’t add a fee (because they don’t pay state taxes), and are thus unaffected by the new IL per-bet tax.”

The risk of driving consumers to illegal offshore platforms is a concern of the industry. The Sports Betting Alliance, a trade group representing FanDuel, DraftKings, and other prominent operators, has repeatedly warned lawmakers that aggressive tax policies could drive consumers to illegal sites.

Illinois’ new policy could become a case study for other state legislatures. In response, operators will likely adopt a clear message: “If lawmakers impose per-bet taxes, expect us to pass them on to voters directly.”

FanDuel and its peers could use this weapon against tax hike proposals elsewhere. For example, Louisiana recently passed a bill that more than doubles the tax on sports betting.

Ohio is another state on the radar. An active bill in the Buckeye State proposes adding a 2% tax on total wagers placed in the state, in addition to the existing 20% tax on revenue (which was already doubled once, and there have been proposals for another increase).

Other examples include New York and Pennsylvania, which heavily tax operators.

Normalizing Consumer Fees?

However, while some industry observers warn of a consumer backlash, others believe the move is part of a broader pricing evolution.

Ruddock observes: “We live in a world where new fees or price increases occur frequently, including streaming subscriptions, ATM fees, and delivery charges, to name a few.”

He adds that it won’t have a significant impact on the consumer:

“This will have a near-zero impact on casual bettors. Casual bettors don’t go broke. They don’t have a bankroll that gets reduced to zero. They have jobs and dedicate a certain amount of their disposable income to betting. The only difference is that instead of betting $10 or $50 per week, they now bet $12.50 or $55.00 per week.”

Given the popularity of small wager parlays with potentially high returns, Illinois bettors may also simply absorb the impact themselves, given that multi-game wagers are often purely for entertainment purposes and to provide interest in a busy sporting calendar.

Déjà Vu: DraftKings Tried This First

FanDuel’s surcharge announcement is not a new idea. Ironically, the operator is doing what DraftKings tried and abandoned last year.

In 2024, facing Illinois’ first tax hike (from 15% to 40%), DraftKings announced plans to add a surcharge on winning bets in states with high tax rates of 20% or higher, such as New York, Pennsylvania, Illinois, and Vermont.

However, the plan was short-lived. Factors such as customer backlash, rejection by competitors (including FanDuel), and adverse analyst reaction forced DraftKings to back out of the plan.

Now, with even higher taxes in Illinois, FanDuel has flipped its stance. While it’s likely to follow, DraftKings might wait and watch closely if FanDuel receives similar backlash.