Israel’s attack on Iran butchered many US stocks last week but gaming companies saw mixed results.

The Dow Jones lost over 700 points, yet major market indices managed to eke out a small gain during the week, extending the positive trend to three weeks.

The Roundhill Sports Betting & iGaming ETF, which is the world’s largest gambling ETF, gained over 2% for the week.

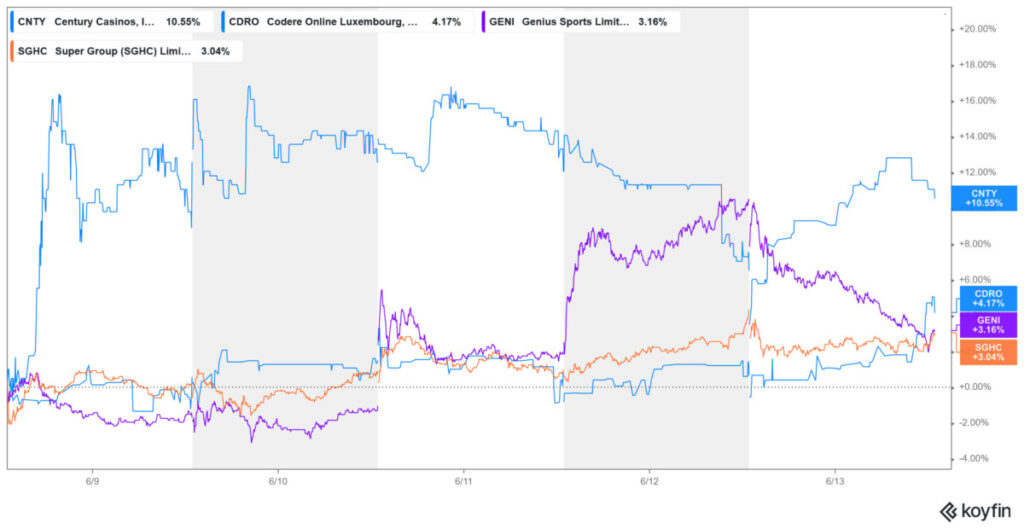

Gaming Stocks with Strong Weekly Momentum

With a gain of 10.5%, Century Casinos was the biggest gainer among leading gaming stocks last week. The stock rose by almost 3.8% on Friday, despite broader markets dipping due to increasing tensions in the Middle East.

However, the stock has lost 32.1% year-to-date, making it one of the worst-performing stocks among its peers this year.

Some reasons for the jump include bullish analyst commentary, particularly from Bank of America and Deutsche Bank, which label it as undervalued. Another factor was investor enthusiasm over renovation progress in Missouri and Nevada properties.

Furthermore, investors welcomed Century’s partnership with BetMGM for the launch of sports betting in Missouri.

Technology provider Gan Ltd. registered a 5.9% gain as the company was officially acquired by Sega Sammy Holdings, marking its departure from NASDAQ.

Codere Online, the digital arm of the Spanish-based Codere Group, climbed 4.2% after filing its 2024 annual report just in time to regain compliance with NASDAQ. That was the second time the company faced delisting by NASDAQ.

The weekly growth for Genius Sports, the technology and sports data provider, was primarily driven by the announcement that the company expanded its partnership with the NFL.

Through the deal, Genius Sports will remain the league’s exclusive distributor of official data feeds and watch-and-bet services until the end of the 2029 season.

Super Group, the parent company of Betway sportsbook, which exited the US last year, has continued its strong performance since the beginning of the year and rose 3.1% last week.

A primary reason was the board’s declaration of a $0.04 per-share cash dividend, signaling the company’s confidence. Also, analysts at BTIG and Zacks remain bullish on the stock, forecasting EBITDA margins over 35% in key European markets.

Underperforming Gambling Stocks: What’s Behind the Slide?

Esports Entertainment Group was the top loser among gaming stocks, falling 16.7% over the past week. Following last week’s drawdown, the stock now trades approximately 62% below its 52-week high.

Investor’s reaction comes amid the absence of news on funding or strategic alliances to keep the company afloat. The lack of news has also increased concerns over the company’s Q1 cash burn of $11 million.

With losses of 6.8%, Sea Limited was the second-worst-performing gaming stock last week. Reasons include geopolitical tensions, such as tariffs on Southeast Asian countries, which affect its e-commerce and gaming businesses.

The company’s gaming arm accounts for a small fraction of its revenue, but investors have sold in fear of escalating geopolitical headwinds.

Light & Wonder Inc. was another loser with a 5.6% stock decline for the week, after Morgan Stanley trimmed its price target, citing a saturated US slot-machine market. Additionally, some insiders have been net sellers, raising concerns among investors.

Bally’s Corporation dipped 5.2% for the week. Concerns are growing over the company’s debt-to-equity ratio, with analysts highlighting that the company is running on significant financial constraints.

While the company faces financial concerns and downgrades in credit ratings, Bally’s is continuing with its $1.7 billion Chicago casino project and pursuing a casino license in New York City.

The Chinese game-streaming platform Douyu International Holdings rounded out the bottom five with a 4.5% decline for the week. This was a result of investors reacting to the company’s disappointing Q1 results, which included an 18% year-over-year decline in revenue and a 12% decline in active users.

Other Key Industry Developments

Last week, Flutter announced 250 job cuts in the UK, primarily at the company’s Leeds office, blaming “increasing cost and regulatory pressure.” The company also doubled down on share repurchases last week as part of its multi-year buyback plan.

In response to the per-wager tax that Illinois has proposed in its new state fiscal budget, Flutter-owned FanDuel announced a 50-cent surcharge on all wagers last Tuesday.

DraftKings followed suit two days later and announced a 50-cent transaction fee effective September 1 on all mobile and online bets placed in the state through its Sportsbook.

Bernstein listed DraftKings as among the best picks in the entertainment sector, along with Spotify and Live Nation. DraftKings’ consensus target price is $54.41, which is almost 50% higher than its current price.

Tuesday evening, Rush Street Interactive announced that it would expand its BetRivers Poker platform into Delaware, Michigan, and West Virginia. Markets gave the announcement a thumbs up, and the stock rose sharply on Wednesday. However, it closed down just over 1% for the week after a 4% drawdown on Friday.